In-depth Summary: Research Notes on Six-Axis Force Sensors

2025-02-27

Q: What is the current competitive landscape of the six-axis force sensor market?

A: In the six-axis force sensor market, there are three major global companies: ATI (USA), BOTA (Switzerland), and ME (Germany). They dominate the global market, mainly supplying to aerospace and industrial machinery sectors with extremely high precision requirements, reaching below 1‰, or even 5‱. Currently, high-end products are mainly from foreign companies, with technological advantages in high-performance materials, customized strain gauges, precision processing technology, and algorithms.

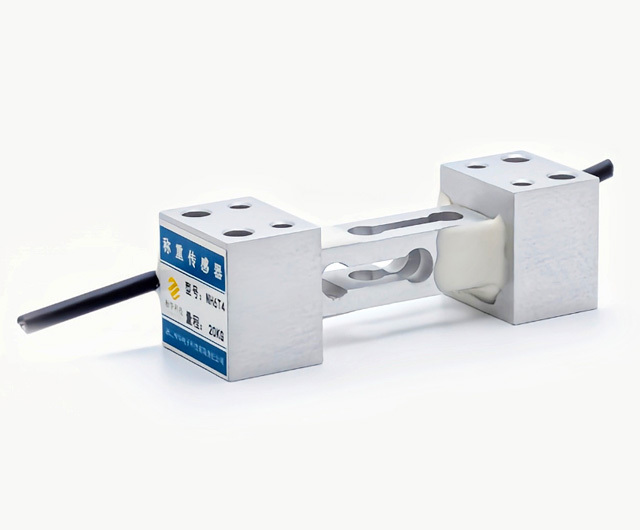

Q: What are the specific technical difficulties of six-axis force sensors?

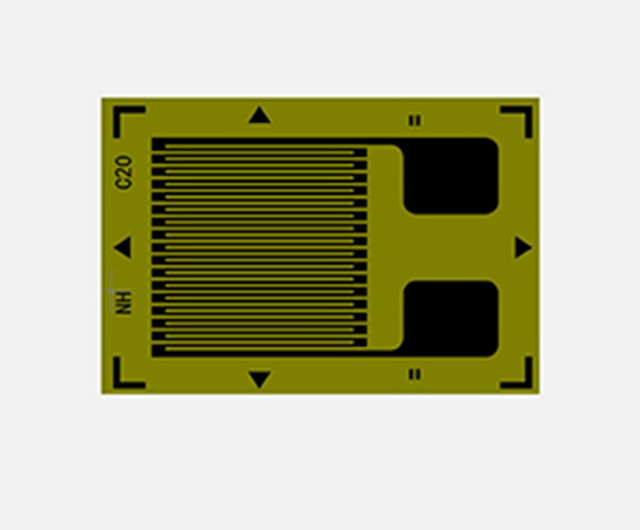

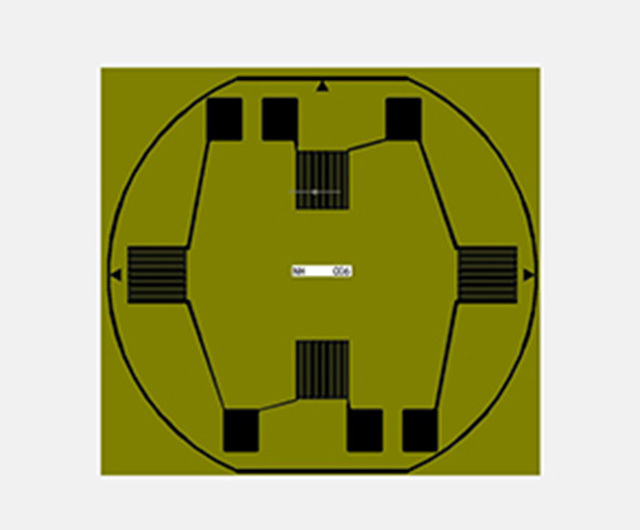

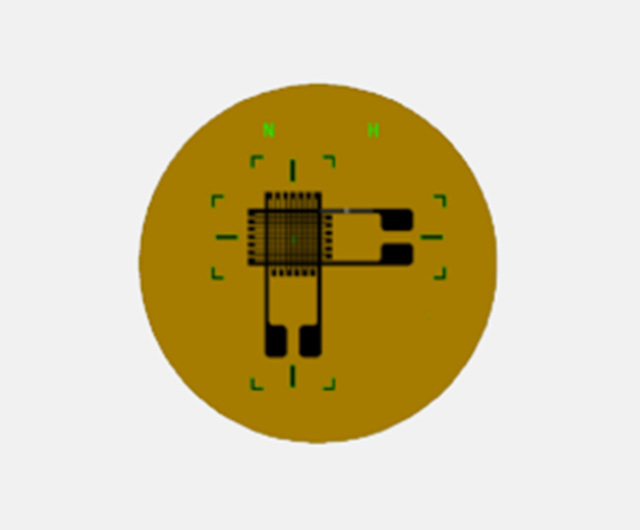

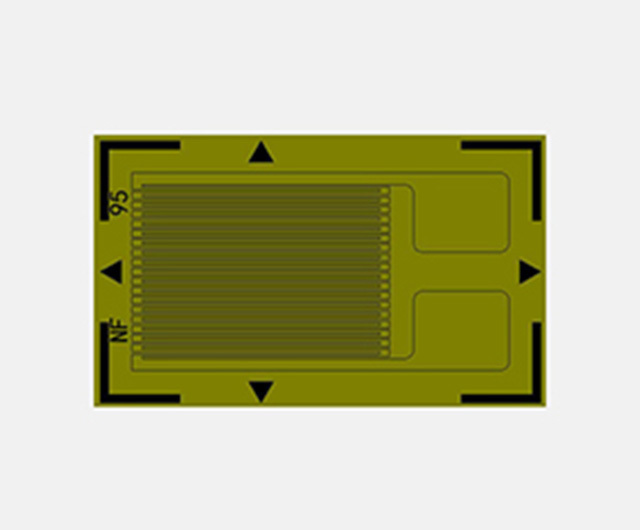

A: The technical difficulties mainly include three aspects: First, the research and development and application of high-performance core materials; foreign countries have advantages in materials, currently surpassing domestic ones. Second, customized strain gauges and precision processing technology, especially high-precision automated chip placement technology, significantly impacts cost and efficiency. Finally, in terms of algorithms, six-axis force sensors need to solve the crosstalk problem of forces in six directions and achieve precision balance through temperature compensation algorithms. This is why many sensors can achieve this at the hardware level but still have precision problems in practical applications.

Q: What is the situation of domestic six-axis force sensor manufacturers and how do they compare to foreign ones?

A: Domestic manufacturers mainly focus on the mid-to-low-end market, such as collaborative robots and medical equipment. Compared with foreign manufacturers, there is a significant gap in material processing and calibration systems. In terms of accuracy, the error of domestic products is generally around 0.1‰, while foreign products have reached below 0.01‰. In addition, domestic products have relatively weak stability, with temperature coefficients generally around 1‰ or 5‰, inferior to the less than 1‱ of foreign products. Regarding core components, domestic manufacturers still rely on imports, especially high-precision special materials. Breakthrough directions mainly include material localization and process innovation, such as developing new special materials and improving chip placement automation and calibration algorithms.

Q: What is the cost structure of six-axis force sensors, and what is the future cost reduction trend?

A: Currently, six-axis force sensors are one of the more expensive components in the robotics industry, but there is significant room for cost reduction in the future. Taking domestic end products as an example, material costs account for 40%. Future cost reduction trends and key points include: First, material localization, such as developing high-precision materials to replace imports; second, process innovation, such as adopting new etching processes, improving chip placement automation levels, and optimizing calibration algorithms. With the development and improvement of these aspects, the cost of six-axis force sensors is expected to be further reduced.

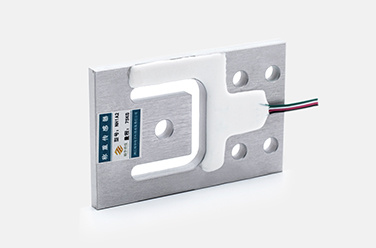

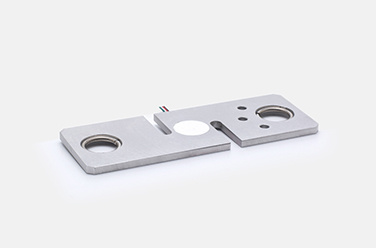

Q: What is the cost ratio of elastomer metal and packaging materials? What are the proportions of processing costs and pricing and testing costs in the total cost, and what are the key processes?

A: Elastomer metal accounts for about 20%, strain gauges for 10%, and packaging materials for 5%, totaling about 40% of material costs. Elastomer technology and strain gauges are the main expenses. Processing costs account for 30% and are one of the main cost components; calibration and testing costs account for 20%, including equipment depreciation and labor time. There is significant room for cost reduction in calibration and testing in the future because the current process efficiency is low, and equipment and product testing are time-consuming.

Q: What are the cost reduction paths for future process optimization?

A: Future cost reduction will mainly be achieved through material substitution (e.g., aluminum alloy replacing titanium alloy), process optimization (e.g., automated chip placement technology improves precision and yield, 3D printing reduces processing and improves production efficiency and reduces costs), and domestic equipment.

Q: What are the main aspects of process difficulties?

A: The process difficulties mainly include three key processes: First, elastomer processing, which requires five-axis machine tools and vacuum suction fixtures; second, strain gauge mounting, which currently mainly relies on imported equipment from Japan, with high automation but high cost; third, algorithms, which are the core of pricing equipment. Precision problems need to be solved through decoupling algorithms, which is one of the core barriers of major companies.

Q: What is the outlook for MEMS solutions?

A: STMicroelectronics does a good job with MEMS solutions, but the accuracy can only reach 3%, which is much worse than mainstream products. The difficulty of the accuracy problem mainly lies in two aspects. First, various anisotropic silicon materials lead to a significant increase in coupling, and it is difficult to achieve complex beam structures in the process, such as the cross beams and tree-shaped beams in six-axis force sensors. The advantage is the low price.

Q: What are the advantages and disadvantages of 3D printing solutions compared to other technical solutions?

A: The advantages of 3D printing solutions lie in their ability to effectively reduce development time and cost. However, its shortcomings are that there are currently no specific products and data to show its accuracy performance, that is, the impact on the accuracy direction has not been verified.

Q: What are the main differences in technical solutions between domestic and foreign leading companies in six-axis force sensors?

A: The main differences in technical solutions between domestic and foreign leading companies lie in structural design and material selection. International companies such as ATI mainly use cross-beam structures, and domestic companies also mainly use cross-beam structures, but the durability of cross-beams is a problem. In terms of material selection, overseas companies tend to use stainless steel and titanium alloys, while domestic mid-to-low-end products mostly use aluminum alloy materials. In general, domestic mid-to-low-end products mainly refer to overseas cross-beam structures in structural design, while using lower-cost aluminum alloys in material selection.

Q: What is your opinion on the competitive landscape and future development trends of the six-axis force sensor industry?

A: At the current stage, the focus of competition among companies in the industry is on process breakthroughs and product R&D progress, especially breakthroughs in precision processing technology and algorithms, forming a high moat. The second half of this year will be an important period to test the key indicators such as the durability of various products. With the iterative optimization of technology and cost, the competition in the industry is expected to become more intense the year after next. In the future, companies that can better solve product durability problems and achieve low-cost iteration of production processes will occupy a dominant position. This industry presents high barriers and high concentration, with limited market capacity but huge value, especially considering the large demand for such sensors in robot applications.

Q: What is your opinion on the current targets of the six-axis force sensor industry? What is the future outlook?

A: Keli Sensing started sending samples last year, such as companies like Xiaopeng. Ampere may have samples by the end of this year. Many companies are gradually deploying, including veteran companies such as Hanwei and other emerging companies. The concentration of this industry should be relatively high in the future, and the market will not have much capacity for the number of companies. Therefore, whoever can better iterate the cost of product production processes in the future will have a very high market share. Considering that robots are mainly used for replacement, this part basically has a usage of 3-4 units. If calculated at 3000 yuan, there should be a considerable value.

Previous page